Content

In this article, we will discuss the formula for predetermined overhead rate and how to calculate it. That amount is added to the cost of the job, and the amount in the manufacturing overhead account is reduced by the same amount. At the end of the year, the amount of overhead estimated and applied should be close, although it https://www.bookstime.com/ is rare for the applied amount to exactly equal the actual overhead. For example, Figure 8.41 shows the monthly costs, the annual actual cost, and the estimated overhead for Dinosaur Vinyl for the year. (Figure)Rulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500 machine hours.

- A pre-determined overhead rate is normally the term when using a single, plant-wide base to calculate and apply overhead.

- Managers and accounting personnel should work together to analyze the historical overhead information to look for relationships between the total overhead and one of the specific allocation bases.

- Because of this decrease in reliance on labor and/or changes in the types of production complexity and methods, the traditional method of overhead allocation becomes less effective in certain production environments.

- Predetermined overhead rates are essential to understand for eCommerce businesses as they can be used to price products or services more accurately.

- Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units.

- When there is a big difference between the actual and estimated overheads, unexpected expenses will definitely be incurred.

With this information in mind, it pays to take some time to calculate your own predetermined overhead rate so that you can manage expenses with confidence. To calculate the predetermined overhead, the company would determine what the allocation base is. The allocation base could be direct labor costs, direct labor dollars, or the number of machine-hours. The company would then estimate what the predetermined overhead cost would be and divide them to determine what the manufacturing overhead cost would be. The price a business charges its customers is usually negotiated or decided based on the cost of manufacturing.

How to find predetermined overhead rate: Example 1

Companies also use an activity base to assign this cost to products, usually the number of units produced. That is, a certain amount of manufacturing overhead is applied to job orders or products which is used to estimate future manufacturing costs. Therefore, the applied costs allocated are different from the actual overhead cost incurred during the production process. At the end of the year, the difference between applied and actual costs is being eliminated.

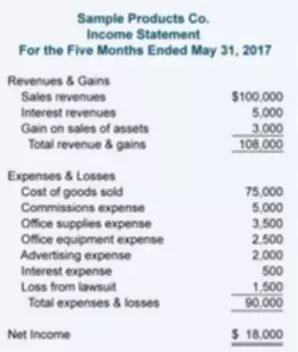

If you’re trying to make an estimate of manufacturing costs, you’re probably wondering how to determine predetermined overhead rate. Based on the above information, we must calculate the predetermined overhead rate for both companies to determine which company has more chance of winning the auction. Large companies will typically have a predetermined overhead rate for each production department. Companies need to make certain the sales price is higher than the prime costs and the overhead costs.

Computing the Predetermined Overhead Rate

In some industries, the company has no control over the costs it must pay, like tire disposal fees. To ensure that the company is profitable, an additional cost is added and the price is modified as necessary. In this example, the guarantee offered by Discount Tire does not include the disposal fee in overhead and increases that fee as necessary. Additionally, you should recalculate your predetermined overhead rate any time there is a significant change in your business, such as the addition of new equipment or a change in your product line. The business owner can then add the predetermined overhead costs to the cost of goods sold to arrive at a final price for the candles.

- Learn more about the standards we follow in producing Accurate, Unbiased and Researched Content in our editorial policy.

- These overhead costs involve the manufacturing of a product such as facility utilities, facility maintenance, equipment, supplies, and labor costs.

- A business can calculate its actual costs periodically and then compare that to the predetermined overhead rate in order to monitor expenses throughout the year or see how on-target their original estimate was.

The allocation base includes direct labor costs, direct labor dollars, or the number of machine-hours. The allocation measure is the measurement the cost to make a product or service. Predetermined overhead is being computed at the beginning of each period of production of a product or service on the allocation base. Allocation basis is such as machine hours, direct labor hours, and direct material. The calculation period of predetermined overhead is starting of the accounting period.

CHEGG PRODUCTS AND SERVICES

This project is going to be lucrative for both companies but after going over the terms and conditions of the bidding, it is stated that the bid would be based on the overhead rate. This means that since the project https://www.bookstime.com/articles/predetermined-overhead-rate would involve more overheads, the company with the lower overhead rate shall be awarded the auction winner. The movie industry uses job order costing, and studios need to allocate overhead to each movie.

Their amount of allocated overhead is not publicly known because while publications share how much money a movie has produced in ticket sales, it is rare that the actual expenses are released to the public. Let’s say we want to calculate the overhead cost of a homemade candle eCommerce business. Fixed costs are those that remain the same even when production or sales volume changes. So if your business is selling more products, you’ll still be paying the same amount in rent. For example, if ABC Manufacturing’s actual manufacturing overhead was $100,000 but their applied manufacturing overhead was only $60,000, they underapplied $40,000.